How myGov can help you track your super

Keeping track of your superannuation balance is key as it impacts how much you can contribute to superannuation and whether you are entitled to other superannuation concessions and measures.

Introduction

Your total superannuation balance (TSB) is an important concept as it impacts your eligibility for up to six favourable superannuation-related measures, including the:

· Bring forward non-concessional contribution (NCC) cap

· Carry forward concessional contributions

· Superannuation spouse tax offset

· Government co-contribution, and more.

In a nutshell, your TSB includes:

· Your superannuation accumulation account balance(s)

· Your superannuation pension account(s), and

· The outstanding limited recourse borrowing arrangement amount in your SMSF that you entered into from 1 July 2018 (in certain circumstances).

Your TSB for the current year is measured on 30 June of the previous financial year (ie, 30 June 2023) when determining your eligibility to make or receive certain types of superannuation contributions.

How to check your TSB

There are two main ways you can track your TSB.

Firstly, you can either contact your superannuation fund or refer to your fund’s statements and records for your TSB. When reviewing your annual statement, the TSB figure your fund reports to the ATO is generally referred to as ‘exit value’ or ‘withdrawal benefit’. This may be different to the 30 June ‘closing balance’.

The second way to check your TSB is by logging into your myGov account which will show your TSB for the previous 30 June as well as other helpful information, such as your:

· Eligibility to use the NCC (after-tax contribution) bring forward arrangement

· Concessional contribution cap

· Unused carry forward concessional contribution cap amounts that have accrued since 1 July 2018

· Employer contributions, and more.

Checking this information can be beneficial before you make any further contributions prior to 30 June 2024 as it can help you avoid exceeding your contribution caps.

The following steps should be taken to track your TSB (and other related superannuation information):

1. Log into your myGov account by visiting my.gov.au. If you don’t have a myGov account you can create an account. Alternatively, if you have a myGov account but have not linked the ATO service to it, you can also link it here too.

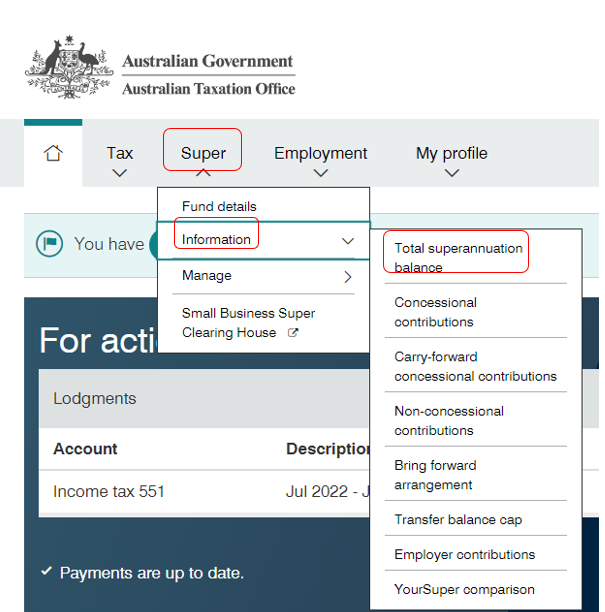

2. Select the super tab, then click on the information option and then click on ‘total superannuation balance’ (as shown in the image below). Here you will be able to see your current TSB as recorded by the ATO.

1. You will be able to see your current TSB for each superannuation interest you hold, including your prior year’s 30 June TSB under the ‘History’ button.

Tip – check the information provided

You should take care when checking your TSB and other amounts displayed in myGov, as depending on the type of superannuation fund you have, your 30 June balance and contribution details may not have been reported to the ATO yet

For example, SMSFs are not required to report their superannuation information to the ATO as regularly as large APRA-regulated funds so your contributions and your account balance may not be up to date in myGov. This is because the ATO obtains information about SMSFs from the annual return each year. This means any SMSF members will need to check their SMSF records to track their TSB and contribution caps if this information is not up to date in their myGov account.

Need help? Please contact us if you need more information on how to check your TSB or if you require further information about your superannuation account.

Harper Group Pty Ltd – Chartered Accountants Frankston - Ph 9770 1547

Disclaimer: All information provided in this article is of a general nature only and is not personal financial or investment advice. Also, changes in legislation may occur frequently. We recommend that our formal advice be obtained before acting on the basis of this information.

Please note we at Harper Group Pty Ltd are not licensed to provide financial product advice under the Corporations Act 2001 (Cth) and taxation is only one of the matters that must be considered when making a decision on a financial product, including on whether to make superannuation contributions. You should consider taking advice from the holder of an Australian financial services licence before making a decision on a financial product.